Your Business Could Collapse Without This Document in Place

Your Business Could Collapse Without This Document in Place

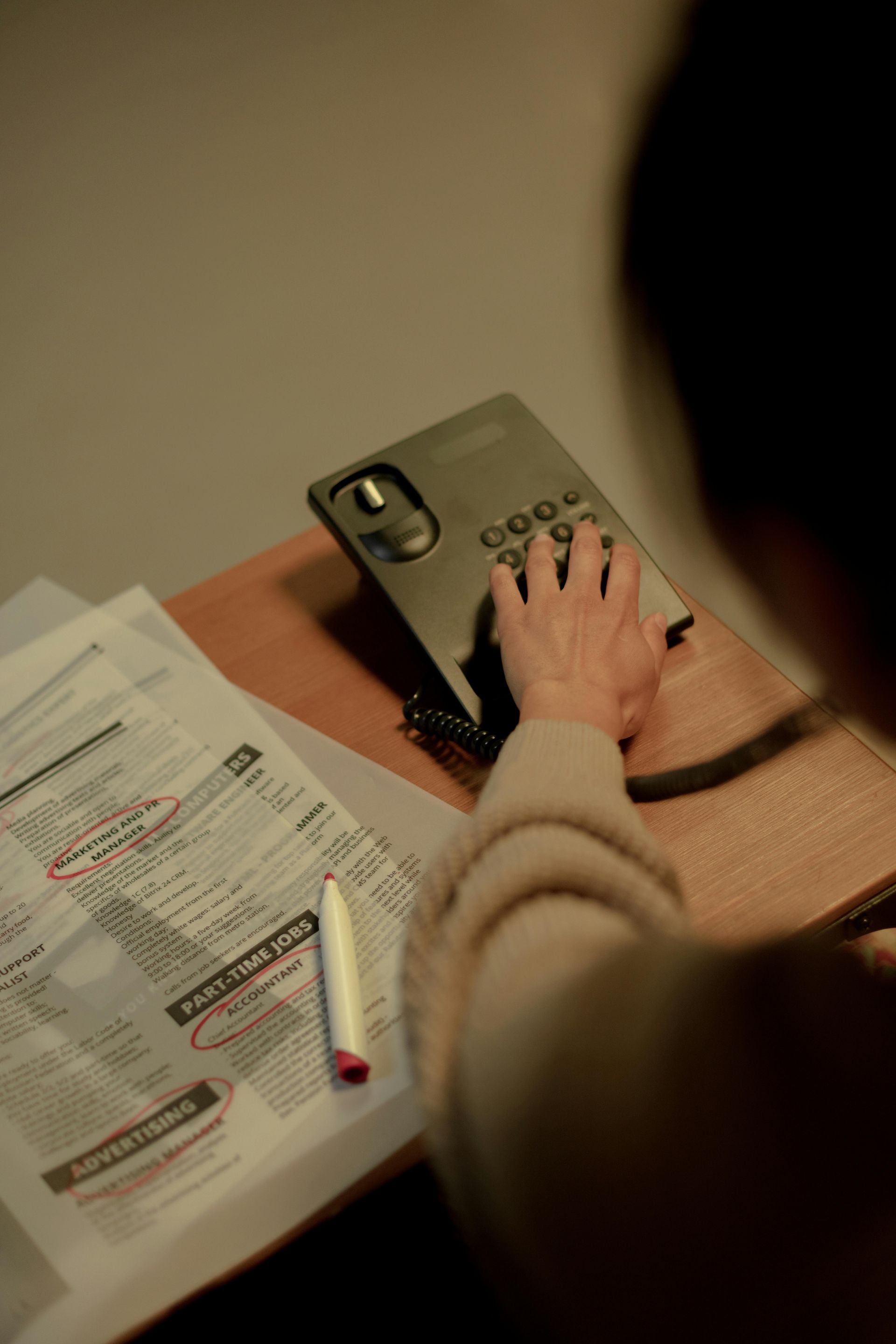

You’ve worked hard to build your business — so imagine if, overnight, you lost the ability to make decisions.

A stroke. A serious accident. A degenerative illness. These things happen, and when they do, your business could be left completely exposed.

X Bank accounts frozen.

X Contracts unsigned.

X Staff unpaid.

X Clients left hanging.

All because one crucial document wasn’t in place: a Business Lasting Power of Attorney (Business LPA).

What Is a Business Lasting Power of Attorney?

A Business LPA is a legal document that lets you appoint someone you trust to step in and manage your business affairs if you lose mental capacity — either temporarily or permanently.

That person (called an “attorney”) can:

- Access business bank accounts

- Pay suppliers, invoices, and staff

- Sign contracts

- Manage property or premises

- Deal with regulators, HMRC, clients, and more

It’s business continuity in a legal form — keeping things moving if you're unable to.

Can’t My Personal LPA Cover That?

Technically — yes. A standard Property & Financial Affairs LPA can cover your business interests.

But here’s the catch:

- The person you’ve chosen for your personal affairs (your partner, a child, or friend) may not be the right person to run a business.

- There may be conflicts of interest between personal and business decisions.

- Your attorney may lack the commercial knowledge, availability, or authority to act confidently.

- Banks and stakeholders may be uncomfortable with a personal attorney making business decisions.

That’s why experts recommend a separate Business LPA — especially for:

- Company directors

- Shareholders

- Sole traders

- Partners in LLPs or traditional partnerships

This gives you more control, better protection, and much clearer authority in a crisis.

What Happens If You Don’t Have One?

Without any valid LPA in place, your business is left in limbo.

Someone will need to apply to the Court of Protection to gain access and legal rights — a process that can take months, cost thousands, and leave your team without leadership during that time.

Clients go elsewhere. Staff lose confidence. Operations slow down. And in the worst-case scenario, your business might not recover.

Protect What You’ve Built

At Hexagon Life Planning, we specialise in helping business owners put the right documents in place — clearly, calmly, and without any legal jargon.

We’ll help you:

✔ Set up a separate Business LPA tailored to your structure

✔ Choose the right person to act as your business attorney

✔ Review any existing LPAs or partnership agreements

✔ Ensure everything is correctly registered and valid

Let’s talk about protecting your business properly.

Click here to book a free, no-pressure business LPA review.